:max_bytes(150000):strip_icc()/xom_cf_march_31_2018_inv-5bfd869dc9e77c0051d9b908-5c5e030846e0fb000158752d.jpg)

- Free cash flow formula from ebitda how to#

- Free cash flow formula from ebitda software#

- Free cash flow formula from ebitda free#

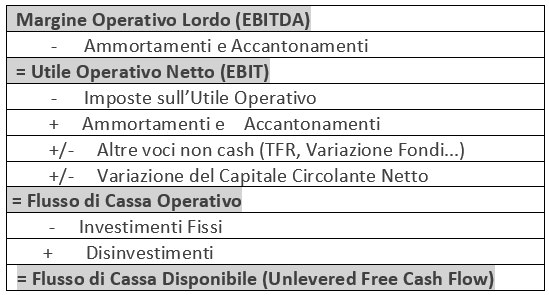

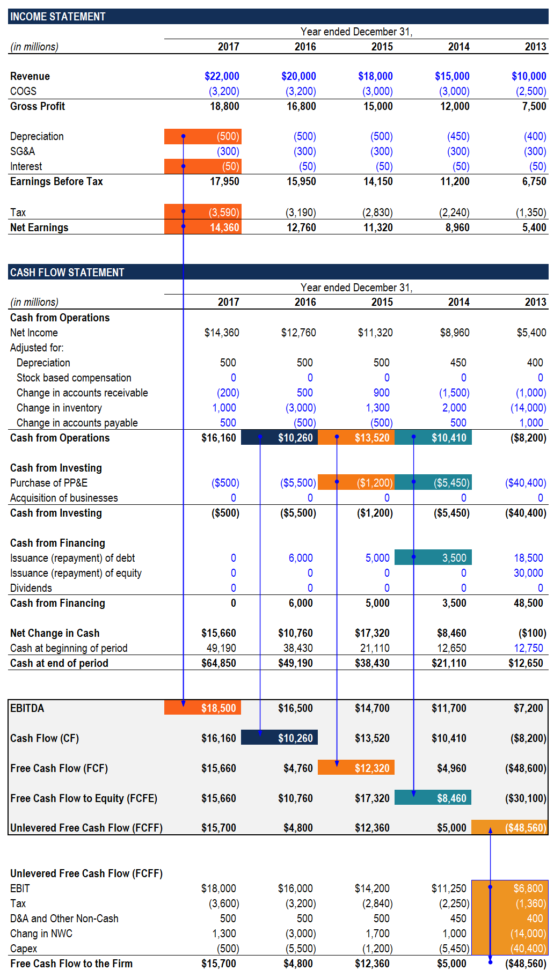

The amount of EBITDA can be easily obtained from the data presented in the income statement, namely as the sum of operating result and depreciation of intangible and tangible fixed assets. Its use as a simplified view of operating cash flow gives analysts a quick idea of the company’s value. EBITDA or earningsĮ = Earnings, B = Before, I = Interest, T = Taxes, D = Depreciation and A = Amortization, in short EBITDA, is another and perhaps even more widespread indicator in the company’s financial management. business owners in the form of profit sharing and bankers in the form of credit repayments, without jeopardizing the functioning of the company.

Free cash flow formula from ebitda free#

This free cash flow can then be used to pay remuneration to providers of financial capital, i.e. Free Cash Flow says how much money the company will have left after deducting the expenses necessary to maintain its production capacity, including the purchase of new or maintenance of existing equipment, facilities and other assets, from its operating income. Financial analysts use it to monitor the amount of cash that can be withdrawn from the company without jeopardizing its operation. If you are now more interested to what extent your company makes money, then you can turn your attention to the indicator hidden under the abbreviation FCF.

Free cash flow formula from ebitda how to#

We described how to do it in our article How to prepare a cash flow statement. If you cannot look in the Cash Flow Statement, you can prepare a cash flow outlook by editing the income statement. If a company compiles a Cash Flow Statement, then it can easily obtain information from it about the increase or decrease in cash and cash equivalents over a period of time – usually a year. However, the question is how to learn such a number from the company’s bookkeeping.

the difference between a company’s income for a certain period and its expenses in the same period. However, few people now wonder about the meaning of the routinely used term Cash Flow. The ambiguity of technical terminology also contributes to the more difficult intelligibility of the language of economic professionals.

Free cash flow formula from ebitda software#

🎓 CAFLOU ® cash flow academy is brought to you by CAFLOU ® - 100% digital cash flow software Cash Flow But what exactly do these terms, also used in common parlance, mean and how do they differ? We will clearly explain these technical terms to you in CAFLOU Academy so that you never get lost in conversation with experts again. We hear and read about cash flow (CF), EBITDA, Free Cash Flow (FCF), OPEX and CAPEX.

LOS 24 (c) Explain the appropriate adjustments to net income, earnings before interest and taxes (EBIT), earnings before interest, taxes, depreciation, and amortization (EBITDA), and cash flow from operations (CFO) to calculate FCFF and FCFE.Financial professionals often use mysterious terms and abbreviations in connection with cash flow management. After-tax interest expense is added to CFO when calculating FCFF. Fixed capital investments are deducted from CFO when calculating FCFF.Ī is incorrect. It is already added back when computing CFO.Ĭ is incorrect. Which of the following is least likely reflected in the calculation of FCFF when beginning with cash flow from operations (CFO)?ĭepreciation is not considered in the calculation of FCFF when beginning with CFO. FCFF is the cash flow available to a firm’s capital providers after deducting operating expenses, working capital expenses, and fixed capital investments.įCFF can be calculated from net income as:

0 kommentar(er)

0 kommentar(er)